Why was Jack Ma's Ant IPO Stalled?

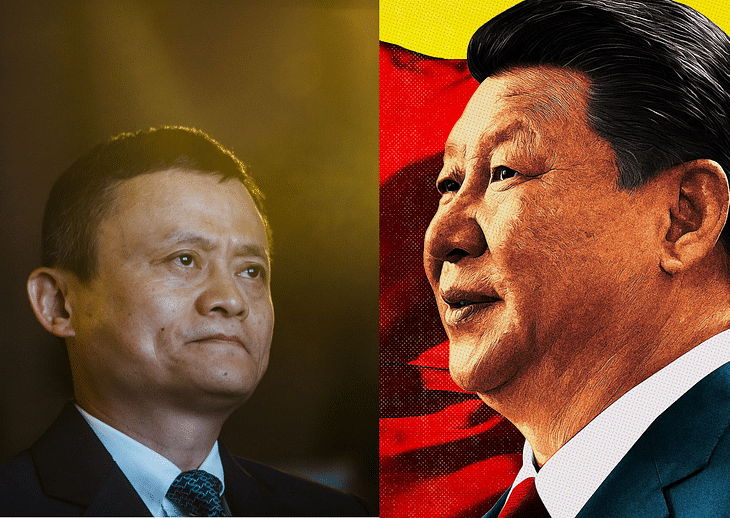

- The Ant Group, which was earlier known as AliPay and Ant Financial, is an affiliate company of Billionaire Jack Ma’s Alibaba Group. The Ant Group recently announced, what is called the world’s biggest IPO to raise $34 Billion(approx Rs 2.51 lakh crore), with the company’s valuation standing at $313 Billion. A day before the IPO was to be launched, it was called off due to problems with the Chinese regulators. Some say it was because of a direct scuffle with the Communist Party of China. It is also said that Xi Jinping, the party supremo and President of the People's Republic of China, directly is involved in stalling the IPO. Let us take a peek into the history of Ant Group and the problems that surrounded the IPO.

From AliPay to Ant Group

AliPay was launched in 2003 as a payment platform/gateway for the e-commerce platform Taobao. Taobao is a subsidiary of the Alibaba Group. AliPay’s slick payment app is synonymous with the UPI or digital payment gateway services in India like PayTM, GPay, BharatPe, MobiKwik, etc.

Years back, e-commerce wasn’t really trusted since it was a fairly new concept. There was a lack of regulation and a lack of trust between buyers and sellers. Transactions were pretty much direct. The buyers doubted that the sellers will dupe them of the money and not deliver the product. The sellers were afraid that the customer might not pay as was necessary. Moreover, if the product turned out to be faulty or misplaced, there was no sure-shot refund method. Maybe you have also used cash-on-delivery while ordering goods from Flipkart back in the day. To address this problem in China?, the Alibaba Group came up with AliPay.

AliPay would receive payment for an order from a buyer and keep it in a third account for the time being. Once the buyer received the order promptly and in proper condition, AliPay would transfer the money to the seller’s account. In case of discrepancies, the amount would be refunded and the product would be shipped back. This laid the basis of modern e-commerce across the world.

AliPay then went on to be rebranded into its parent company, Ant Financial, which later became Ant Group. Ant Group ventured various different financial services and products and services. Most of its revenue came from its online lending businesses(39.4%) followed by digital payment and merchant services like AliPay(36.9%). Their products include:

- Alipay – a mobile wallet app that supports make and accept payments.[59]

- Huabei (Ant Credit Pay) – a virtual credit card type of product that facilitates credit payments.

- Jiebei (Ant Cash Now), a consumer loan service.

- Ant Insurance Services.

- MYbank – a cloud-based private online bank

- Ant Fortune – a comprehensive wealth management app.

- ZOLOZ – a global biometric-based identity verification platform.

- Zhima Credit – an independent credit filling and scoring service for individuals.

HiRevenue Sources from Various Different Services of Ant Group

Vital Information on Ant Group’s Services

Why was Ant Group’s IPO Cancelled?

The Ant Group’s IPO was bigger than India’s Gross Domestic Product(GDP). It received bids worth more than $3 trillion. The company intended to raise $34 Billion, with the company’s valuation standing $313 Billion. The demand for the issue was so big, that the Ant Group decided to stop taking orders a day earlier than planned. The issue was expected to go live on both Shanghai and Hong-Kong stock exchanges. However, the IPO was called off at the last moment.

There are various speculations as to what could have gone wrong. Most of them hint at bad blood with the ruling Communist Party of China. Jack Ma had criticized China’s financial regulators and the financial system and how it stifled innovation in that field. The Chinese regulators who were at the conference didn’t take the criticism well. According to some reports, Xi Jinping, the state supremo, personally made the call and got the IPO stopped.

Right after the conference, the market regulators started making reports on how the Ant Group encourages the youth to take on a debt burden. This capitalistic expansion of Ant Group is apparently against the Communist principles of the nation. The company’s account books suggest that Ant Group itself only assumes the risk for 2% of the debt that is given through its lending platforms. In the essence of it, this is because Huabei and Jiebei, its two lending platforms are simply connecting banks and borrowers, where it itself doesn’t assume any risk whatsoever.

Will the IPO Go Through?

Hopefully, yes. The IPO has faced a lot of turbulence. Firstly from the Chinese regulators and even from Donald Trump. The Trump administration wanted to blacklist the Ant Group and prevent US Investors from putting their money in the IPO. However, the plans for the blacklist were called off later.

The Chinese regulators have now published new norms for online lenders and micro-lending which Ant Group will have to comply with. The regulators have even placed more obstacles for Ant Group to cross such as new capital requirements and some changes in the IPO. The entire process could take anywhere from 3 to 6 months before the IPO goes into effect.

Well, one thing is clear, even China’s richest man isn’t greater than his political bosses. The stalling of IPO cost Jack Ma, $3 Billion, and that is a lot of money. It is well before the time that we know who are the forces behind the stalling of the IPO.

Post your comment

No comments to display