What is Bitcoin? How it Works, Advantages and Legalities

Since its 'mysterious' entry almost 12 years ago, Bitcoin has become one of the most highly discussed topics in the world. Let us take a look into the why's and how's of Bitcoin's popularity.

Bitcoin is a digital currency that was created in January 2009. It provides secure global transactions very quickly and without third-party manipulations. The concept was introduced through an online document by ‘Satoshi Nakamoto’, which was an alias or pseudo-name. Till date, the identity of the person (or persons) who created Bitcoin is a mystery. People from all over the world have been trying to find out the brains behind this revolution in financial technology.

The document titled “Bitcoin: A Peer-to-Peer Electronic Cash System” explained a unique way to create transactions without a regulatory third party. This meant that people could exchange values or conduct transactions on the internet without having to rely on an entity to validate it. Unlike normal currencies, Bitcoin would not be issued by any government, and banks would not manage accounts or validate transactions. It would be based on a cryptographic system that uses certain codes and numbers to keep information safe and secure.

Bitcoins can be accepted as a means of payment for products sold or services provided. It also offers the promise of lower transaction fees, as compared to traditional online payment mechanisms.

How Does Bitcoin Work?

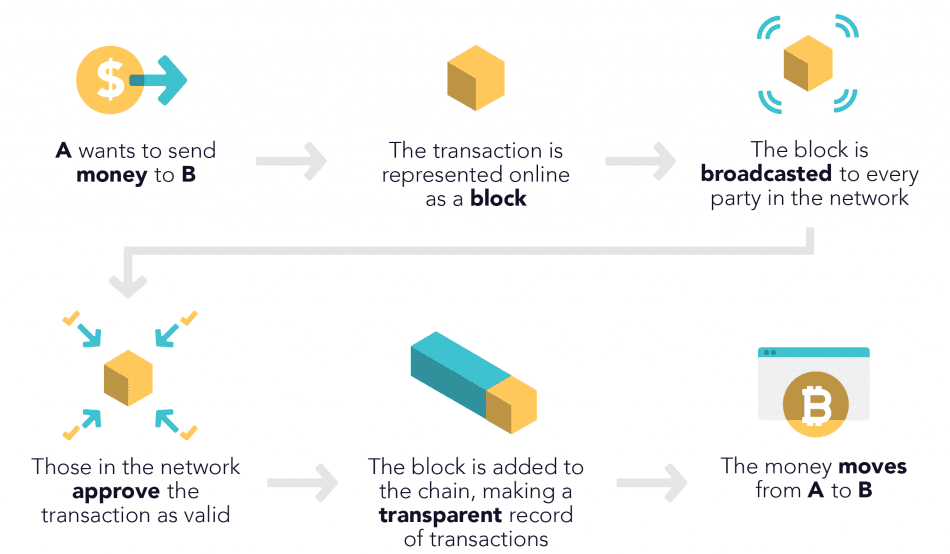

Bitcoin is created, distributed, traded, and stored with the use of a decentralized ledger system, known as a blockchain. A blockchain can be thought of as a collection of blocks. In each block, there would be a collection of transactions. There are specific computers (or nodes) that run Bitcoin’s code and store its blockchain. In simple terms, each transaction is a ‘block’ that is ‘chained’ to the code, creating a permanent record of each transaction.

A bitcoin wallet contains a public key and a private key, which work together to allow the owner to initiate and digitally sign transactions. This ultimately helps in providing proof of authorization. More importantly, there are bitcoin miners that independently confirm the transaction using high-speed computers. Bitcoin mining is the process of creating new bitcoins by solving certain complex math puzzles. It is necessary to maintain the ledger of transactions upon which bitcoin is based.

There are no physical bitcoins, and all balances are kept on a public ledger that everyone has transparent access to. No one can hack into the network and alter records. Bitcoin developers often reveal security concerns to the public to produce robust solutions.

How Does a Person Obtain Bitcoins?

- As mentioned before, people compete to mine bitcoins using high-speed computers to solve complex math puzzles. Basically, they sell their computing power to maintain the record for the chance to (maybe) earn bitcoins. This is how bitcoins are made.

- There are bitcoin exchanges that allow people to buy or sell bitcoins using different currencies. Coinbase, Bitstamp, and Bitfinex are prime examples of such exchanges.

- People can send bitcoins to each other using mobile apps or their computers. It is very similar to sending cash through digital payment apps (such as Google Pay). Internationally, this is done through tools such as Bisq, Bitquick, and LocalBitcoins.com.

High Volatility of Bitcoin

The price of a bitcoin is primarily determined by its supply and market demand. The important factor to be noted is that the supply of bitcoin is limited. There are only 21 million bitcoins that can be mined. The cost of producing bitcoin through the ‘mining’ process also affects its price. It can also be based on the reward issued to bitcoin miners for verifying transactions.

Given below is a graph showing the price of bitcoin over the past 10 years:

Historically, the value of Bitcoin has been very volatile. The first real price increase occurred in July 2010 when the valuation of a bitcoin went from around $0.0008 to $0.08 for a single coin. Bitcoin showed a huge rally in 2017. In October of that year, the price broke through $5,000 and doubled again in November to $10,000. On December 17, the price of one bitcoin had reached $19,783. However, just a few weeks later, the price fell rapidly- crashing down below $7,000 by April 2018 and below $3,500 by November 2018.

Since 2017, many people have started to show interest in using or obtaining bitcoins. Last year, we saw that prices started at $7,200 on January 1 and closed above $28,800 on December 31. As of January 8, 2021, its price had touched over $41,900! Bitcoin has gained more popularity and acceptance as a medium of exchange. Institutional investors have been pumping in millions of dollars into bitcoin over the past few months.

Many factors cause panic amongst bitcoin users, which ultimately leads to a fall in its price. This could include certain geopolitical tensions and the uncertainty of its future value. Cryptocurrencies are also prone to security breaches. Bitcoin could become volatile when the bitcoin community (or network) exposes security vulnerabilities.

Advantages & Disadvantages of Bitcoin

Advantages:

- Bitcoins are very accessible and have high liquidity. It is very easy to cash out and sell your bitcoin.

- There is improved security- its users can check all transactions through the transparent public ledger. Bitcoin transactions are secure, irreversible, and do not contain any sensitive or personal information of customers.

- Bitcoin can be transferred 24/7 to any person in any part of the world, without intermediaries in between. International money transfers with bitcoins can be faster and cheaper, as compared to traditional banking services.

- The transaction fees paid by a user to make payments through bitcoin is very low.

- Inflation has caused many currencies to get their value declined with time. There are only 21 million bitcoins released in the world. As the demand increases, its value will increase, which will keep up with the market and prevent inflation (in the long run).

Disadvantages:

- The use of bitcoin is unregulated. Bitcoin has been used as a mode of exchanging money in a lot of illegal deals in the past. It is difficult for governments to track any bitcoin user or keep a tab on their data. Thus, various countries are very sceptical about their citizens investing and using such cryptocurrencies.

- Bitcoin has limited use, as it is currently only accepted by a few online merchants.

- As mentioned earlier, bitcoin prices are extremely volatile. It can drop very quickly and reach very low prices.

- If a person forgets or loses their credentials to unlock a bitcoin wallet, their coins get locked away. There is no option to retrieve those bitcoins.

- Mining bitcoins requires a lot of computational power and electricity input. This makes it highly energy-intensive.

- Cryptocurrency exchanges are not very secure. Sensitive data that is stored on these exchanges can be stolen by hackers. Exchanges, such as Bitfinex or Mt Gox, have been hacked in the past years, and bitcoin has been stolen in thousands and millions of US dollars.

Is Bitcoin Legal in India?

Bitcoin has neither been authorized nor been regulated by any central authority in India. However, buying, selling, trading, or mining bitcoins is not illegal by any law. There are no rules, regulations, or guidelines for resolving any disputes that may arise while dealing with bitcoins. Also, cryptocurrencies are not legal tender in India.

Between 2017 and 2019, it has been estimated that Indian investors have lost more than $500 million (~Rs 3,668 crore) in cryptocurrency scams. Crypto scammers also engage in creating fake crypto wallets. Innocent investors often fall into their trap and lose their hard-earned income. In 2018, the Reserve Bank of India (RBI) prohibited any entity from providing banking services to anyone dealing with virtual currencies. Cryptocurrency Exchanges filed a lawsuit against RBI in the Supreme Court and won the case in March 2020. The central bank’s ban was overturned, as the RBI had not presented any empirical evidence that cryptocurrencies have negatively impacted the banking sector or other regulated entities.

In December 2020, a scam of nearly Rs 1,000 crore involving cryptocurrency trading through multiple exchanges came to light when the Enforcement Directorate (ED) arrested a cryptocurrency trader in Gujarat.

There are reports which suggest that the Union Cabinet will soon introduce a law to ban cryptocurrency trading in India. Many have invested in bitcoin and hold the cryptocurrency in our country. If a ban comes into effect, reports state that individuals may be given a period of up to three months to dispose off their assets.

Post your comment

No comments to display