The Harshad Mehta Scam of 1992.

Harshad Mehta, the Big Bull, the man who changed the face of the Indian share market, is also known for committing one of the largest financial scams in Indian History exposed by Journalist Sucheta Dalal in her Times of India article. The amount of the scam was close to Rs 4,500 crores.

Mehta was born on 29 July 1954 in Paneli Moti in Rajkot, Gujarat. He spent a part of his childhood in Mumbai till his family moved to Raipur, Chhattisgarh. He returned to Mumbai where he studied B.Com at Lajpat Rai College. Mehta went on to do many odd jobs till he joined New India Assurance Company Limited(NIACL) as an insurance sales executive in Fort, Mumbai. The Bombay Stock Exchange building or Phiroze Jeejeebhoy Towers was just minutes away from his workplace and which he would often visit in his free time, only to be awestruck by the way things worked at the exchange. It was during this period that Mehta developed a keen interest in the stock market.

Mehta then joined Harjivandas Nemidas Securities as a Jobber/Broker for Prasann Pranjivandas who Mehta considered as his ‘Guru’. Mehta worked his way to the top in the profession. He went on in starting his own firm called GrowMore Research and Asset Management Ltd. in 1987. His influence on the Dalal streets earned him a name. Media houses referred to him as ‘The Raging Bull’, ‘The Big Bull’ and ‘Amitabh Bachchan of Stock Market’

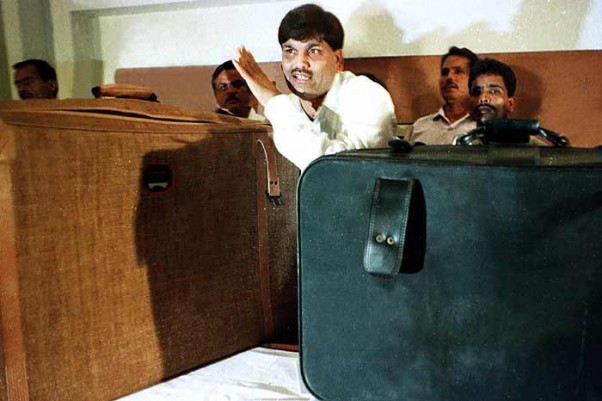

The Big Bull

Mehta was a master manipulator, his influence on the market and contacts with other participants helped him rig the prices of shares. He adopted a practice in the market called "Pump and Dump", where he would manipulate the market. Mehta would use huge sums of money to buy a particular share from the market. This would naturally increase the demand for the share and create buying pressure in the market. Then, Mehta, through his jobbers and brokers, would spread a word of mouth in the market, and people eventually started speculating the market based on Mehta's tips. When retailers enter the stock, the prices would again jump up. Once the stock would touch the ceiling, Mehta would start selling his shares and booking huge amounts of profit. This was a common practice back in the day since SEBI didn't have any statutory powers and the market remained unregulated. In fact, SEBI was established only on 12 April 1988 and given powers to take action almost 4 years later on 30 January 1992.

The market would essentially be controlled by brokers, especially the powerful ones. They would group together and drive market prices up and down. The ones who benefitted from rising share prices were called the 'Bull Cartel' and the ones who benefitted from a fall in share prices and short selling were called the 'Bear Cartel'. The Bull Cartel like Mehta drove the share prices up, whereas the Bear Cartel drove the share prices down.

Mehta’s reputation on the market earned him celebrity status. Mehta’s stock tips were most sought after, speculators blindly invested in stocks suggested by Mehta. At the time, it was believed that Mehta’s touch turned any company’s stock into gold. As an example, he took the price of ACC or Association of Cement Companies stock from Rs 200 to Rs 9000 (a 4,400% increase) in a very short span of time. Such a sharp increase in prices was noticed in many other companies’ stocks.

Between 1991 and 1992, the value of SENSEX, the benchmark index of the Bombay Stock Exchange, increased by FOUR TIMES(from 1250 points to 4460 points) in just one year’s time. Such a phenomenon had never occurred before.

Mehta's activities were noticed by market watchers with a suspicious eye. To kill their suspicion and justify his action on the market, he propagated a theory called the 'Replacement Cost Theory'. Mehta justified his actions by stating that the value of a company shouldn't be based on its current earnings, but rather on what it would cost to replace the company with a new one, if it didn't exist. This was essentially a sham theory to kill the suspicion in the market.

Mehta and his media hype added brand value to the profession of stockbroking and investing, market volumes were up like never before. He would flaunt his 12,000 Sq. Ft. home in the poshest areas of Mumbai with a private golf course and moved around in the most luxurious cars in town. Such wealth and lifestyle weren't previously associated with the stock market. What took the Ambanis decades of struggle to gain popularity with the press, the government, and regulators to earn a presence in the market, Harshad Mehta gained it in a matter of few years. Something seemed fishy and Journalist Sucheta Dalal had caught the air of it.

The Scam

- The scam happened around the time when India had begun opening up its economy. The LPG (Liberalization, Privatization, and Globalization) Policy of 1991 opened up many opportunities in terms of business and innovation The policy brought its own set of loopholes in the financial markets of the country.

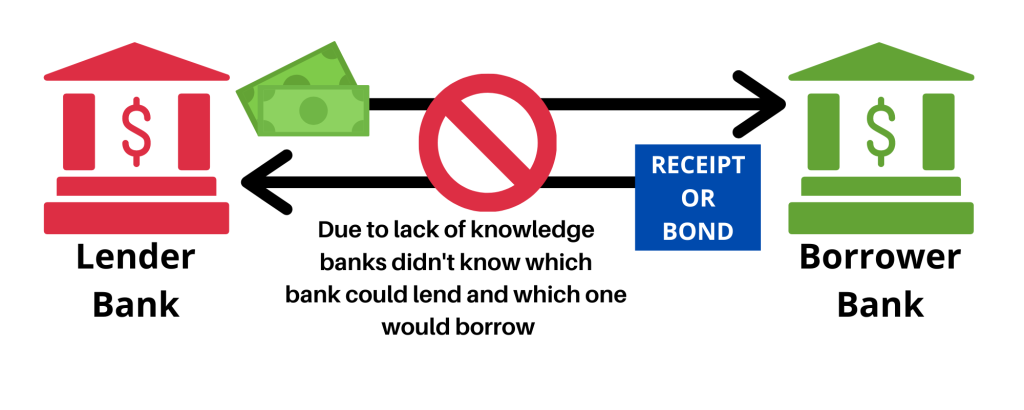

- In the '90s, banks were not allowed to invest in the share market. In order to fulfill their monetary requirement, they would either borrow from the Reserve Bank of India(RBI) or from other banks in a Ready Forward Deal(RFD). This happened through government securities or government bonds(G-Sec).

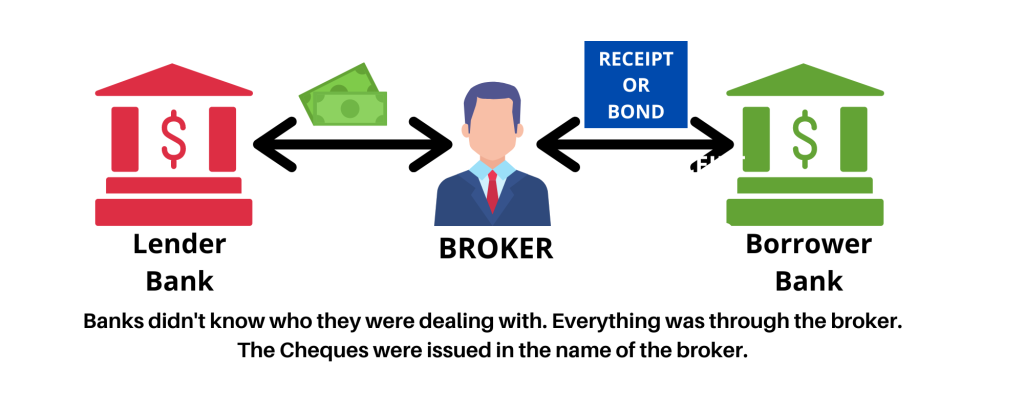

- In a Ready Forward Deal(RFD), the lender bank would lend money and take government bonds from the borrower bank for a maximum of 15 Days. The lender bank would get the money back, with interest. However, banks did not know which bank to approach in case they wanted to lend or borrow. So the transaction between banks happened through 'brokers' who had knowledge and contacts in the market. In this case, Harshad Mehta acted as a broker.

- Mehta had really great contacts in the banking system and money markets. The trade was so secretive that banks wouldn't know which other banks they were dealing with. Mehta used this to his advantage. All cheques were issued in his name and not in the name of the concerned bank

- The RBI's Public Debt Office (PDO) maintained a handwritten record of all government bond transactions in what is known as SGL or subsidiary general ledger. The bank which would borrow money would provide the lending bank with an SGL Form. After some time, the borrower bank would pay back the amount with interest and collect its SGL Form back. The SGL forms were backed by securities.

- The SGL was difficult to maintain as it had to be done manually. There would be many human errors that would creep in and that made SGL Form transfer inefficient. Soon Bank Receipts or BRs were introduced to replace them.

- Bank Receipts or BRs were given to the 'Lending Bank' to acknowledge their payment and that the money will be paid back with the interest decided. These Bank Receipts (BR) were NOT backed by any securities and DID NOT have a centralized ledger.

- HERE COMES THE SCAM: Mehta tied up with officials at Bank of Karad and Metropolitan Cooperative Bank and printed fake Bank Receipts. Mehta would go to the 'Lending Bank' and get the money from them in exchange for these Fake Bank Receipts. He would then invest this money to rig the stock market.

- What about the 'Borrower Bank'? How would Mehta give them the borrowed money? Mehta would borrow money from a 'third bank' for these fake Bank Receipts just as he did with the previous bank and then pay the 'Borrower Bank'.

- Mehta was in touch with many such banks and actually had everyone, right from the clerks to the top-level management in his pockets. He had bribed many officials

- Mehta would, directly and indirectly, buy certain stocks in bulk which would then have skyrocketing prices. This would put people in the perception that whichever stock Mehta chose would turn into gold. Eventually, more people would invest in these stocks, which would further drive up prices.

- When the prices would reach their peak, Mehta and his associates would book ENORMOUS profits!

- The magnitude of money involved was tremendous. Almost ~Rs.4500 crores is said to have been displaced in this scam. This scam couldn't have been done alone by Mehta.

Exposed!

- On April 23, 1992, Journalist Sucheta Dalal in The Times of India reports that the State Bank of India has asked The Big Bull to square up Rs 500 crores of irregularities. This caused mayhem in the country, and the SENSEX crashed. There was chaos in the parliament as well.

- The National Housing Bank, wholly-owned by RBI, was accused of transferring money to Harshad Mehta for him to cover up the displaced amount. The chairman resigned shortly.

- The scam involved officials from SBI, Brokerage Firms, Bureaucrats, Politicians, directors, and small-time employees of banks. There was extensive bribery to run the scheme of affairs. Many were arrested and asked to resign, offices were raided, several assets belonging to businessmen were attached. The country was shaken.

- Standard Chartered, ANZ Grinlays, Bank of America, Andhra Bank, UCO Bank, and many more such banks were involved.

- The CBI, RBI, SEBI, Income Tax Department, State Police. Almost every possible machinery was involved in the investigation.

- P. Chidambaram, who was in the cabinet resigned. His wife owned 25,000 shares in Fairgrowth Financial Services, which was a part of the scandal.

- Finance Minister Manmohan Singh was asked to resign, which was however not accepted by the then Prime Minister PV Narasimha Rao.

- The Jankiraman Committee and a Joint Parliamentary Committee were set up to investigate the claims involved in the scam.

- Mehta claimed that he had bribed the then-PM PV Narsimha Rao almost Rs. 1 crore for clearing him of charges. His claims were refuted by the authorities.

- Mehta and his family members were banned for life from trading on any exchange in India.

- Harshad Mehta was charged with 72 criminal offenses with more than 600 criminal action suits. He was arrested and later released on bail. However, In September 1999, Mehta was sentenced to 5 years imprisonment a laughable Rs 25,000 fine. Mehta died in prison on 31 December 2001 from a heart attack as reported by the media.

Aftermath

- Mehta had made use of loopholes in the market to commit fraud. An attempt was made by regulatory authorities to correct these frauds.

- SEBI or Securities and Exchange Bureau was given statutory powers and could now regulate the market.

- SEBI banned short selling until the ban was lifted in 2006. Insider Trading was made illegal.

- The sale of shares done through tainted brokers or brokers involved in the scandal was banned. The common man was affected by this since most were unaware of what was happening, these shares were called tainted shares. The sale of such shares was permitted later.

- The Bank of Karad and Metropolitan Cooperative Bank which made the fake Bank Receipts were liquidated and closed, since their liabilities were much more than their assets.

- The Narasimham Committee was formed to tighten loopholes and bring reforms to the system after the 1992 scandal.

The Income Tax department claimed that Mehta's GrowMore Research and Asset Management Ltd. owed more than Rs 11,000 crores in taxes which Mehta's lawyer refuted stating that Mehta's lifetime earnings were less than Rs 3,000 crores at the time. Over 27 years, in the appeals filed by his wife and family, the IT department deleted over Rs 2,000 crores of taxes that were in his name and even gave tax refunds.

Just like Mehta, Big Banks were also misusing the same loopholes, however, Media attention, regulatory authorities, and the cases were primarily driven only against Mehta.

Could this have been an attempt by the Big Bosses to distract the public and media attention away from them? Was Harshad Mehta being made a scapegoat as claimed by him? There are a lot of questions left unanswered following his death. A detailed log of events that happened in the Harshad Mehta Scandal and the Ketan Parekh Scandal have been given in the book 'The Scam: Who Won, Who Lost, Who Got Away' by Sucheta Dalal and Debashish Basu. You can buy it here.

Mehta has been back in the news with the launch of the 10 Part web series 'Scam 1992', based on the book by Sucheta Dalal and Debashish Basu. The series portrays all the incidents surrounding Harshad Mehta, from the day he lay his first step into the Bombay Stock Exchange, right to the day he took his last breath at Thane Prison. The series is both informative, intriguing and is a must-watch even if one is a beginner in the world of finance. You can watch the trailer for 'Scam 1992' here, or the entire series on SonyLIV here.

Post your comment

No comments to display