Consolidated vs Standalone Financials: Reading Company Results

While reading company results we often come across the terms "Consolidated Results" and "Standalone Results". The big question is, which one should you use to assess a company's health? Let's find out what the terms mean.

Consolidated Statement

- Consolidated statements represent the financial position of a company and its performance including its subsidiaries, joint-ventures and associate companies.

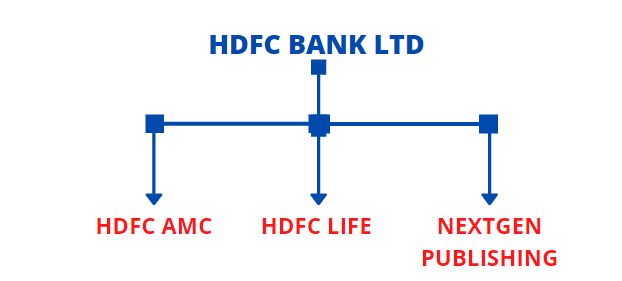

For example: Let us assume the example of HDFC Bank. HDFC Bank (Parent Company) has many subsidiaries like HDFC Life Insurance, HDFC Asset Management Company (AMC), NextGen Publishing to name a few. For the purpose of understanding, let us just take three.

- Now HDFC Bank performs regular retail banking operations along with running subsidiaries such as an AMC, an insurance company and a publishing house. Each of these subsidiaries adds wealth to their parent company i.e. HDFC Bank LTD.

- When we consider the consolidated statements of HDFC Bank Ltd. we also consider the contribution of its subsidiaries in consideration along with the HDFC retail banking activity i.e. AMC, insurance company and publishing house plus the functioning of the bank.

Standalone Statement

Standalone financial statements consider the functioning of the company as a single entity and do NOT include the contribution of its subsidiaries.

For example: When you go through the standalone financial statements of a company, you read the financial position of the company with respect to its banking functions ONLY or all those functions which only HDFC Bank Ltd. performs as a separate entity not taking into consideration the contributions of its subsidies generally.

Consolidated or Standalone financials. What to use?

As a rule of thumb, if you want to know the total overall financial strength of the company you mostly read the Consolidated financials of the company.

When would the need to read standalone financials arise? Generally, when there is no direct business-related intervention into its subsidiaries and associates you consider the standalone statement of the company. Otherwise, when you wish to analyse the financial health of the parent company as a separate entity you may read the stand-alone statements

A good investor analyses BOTH consolidated and standalone statements to figure out shortfalls in the companies or any of their subsidiaries.

Post your comment

No comments to display