Rally May Not be Done Yet: CDSL Stock Analysis

CDSL or Central Depository Services Ltd is one of the two central depository services in India. You may have received several emails from them as you opened your Trading & Demat accounts. It was established in 1999 with the Bombay Stock Exchange (BSE) as its promoter. The depository became the first to hit 3 crore active users in India.

The company has given a staggering ~272% return on investment over the past year. Before this, the share price was moving pretty much in a consolidated manner. There is definitely something that has triggered retail investors across the market since such returns were not seen in the past even when CDSL had healthy financials.

From an investor’s perspective, CDSL is a ‘unique’ company. The company has a sustainable business model and stable financial growth over the years. In this piece, we discuss CDSL’s business model, financial stability, and growth prospects for the future.

CDSL’s Business Model

The profits and stock returns of CDSL have increased after the COVID-19 lockdown was imposed last year in March 2020. India has managed to add the highest-ever number of 49 lakh Demat accounts in FY 2020. The company has 589 registered Depository Participants(DPs) across India and 290 lakh investors across the country.

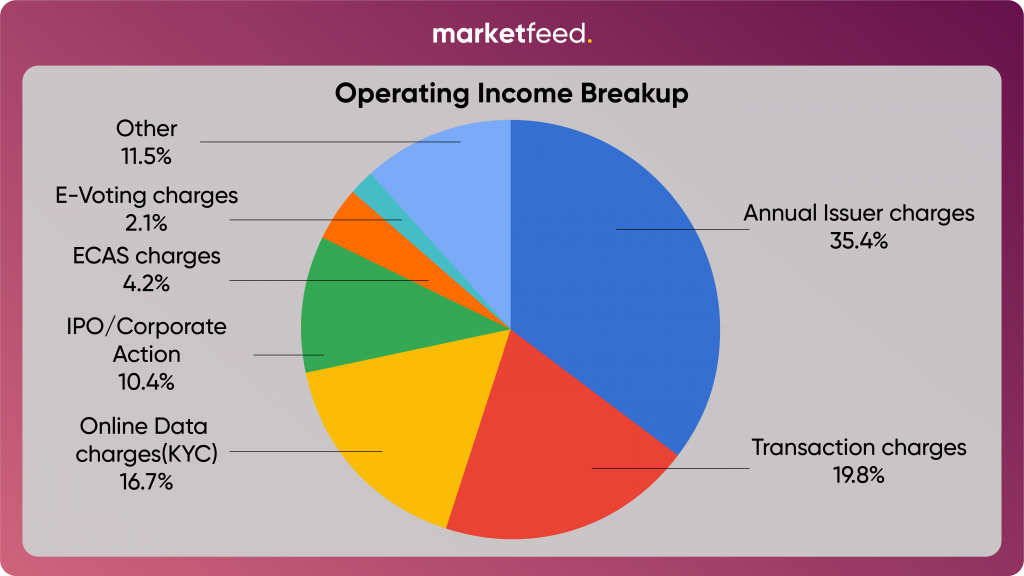

Speaking of Demat accounts, CDSL earns close to 60% of its revenue directly or indirectly from Demat accounts. If you look closely at the revenue breakup, CDSL earns most of its revenue from Transaction Charges and Annual Issuer Charges.

Transaction Charges

Every time a transaction takes place CDSL levies charges on it. A transaction can be buying, selling, or transfer of securities. The number of transactions has increased considerably over the past year and so has the income from the ‘Transaction Charges’ segment.

Annual Issuer Charges

Coming to the Annual Issuer Charges segment. This is the cash cow of CDSL. According to SEBI regulations all listed companies need to establish a connection with both NSDL and CDSL. Listed companies pay ‘Annual Issuer Charges’ to both NSDL and CDSL. The ‘Issuer’ over here is the company whose shares would be traded. SEBI regulates ‘Annual Issuer Charges’ and renews them every five years. This is a fee that the depository charges to listed companies for being a custodian of their shares. Remember that even though shares are ‘traded’ on stock exchanges, they are ‘stored’ in depositories, which requires complex data warehouses that need maintenance.

Largest KYC Registry

The Online Data Charges segment refers to KYC services offered by the company. ‘KYC’ or Know Your Customer is a very familiar term today. Opening a bank or Demat account or even investing in a mutual fund requires a KYC. It is a security verification process used by banks and companies to avoid financial fraud and money laundering activities. CDSL is the LARGEST KRA(KYC Registration Agency) in India holding 60% of the market share in the KYC of the capital market.

Other Income

The company offers services involving the transfer of securities during an IPO. It provides other services like hosting e-Annual General Meetings(e-AGMs) and e-voting for a nominal charge. The company also charges Electronic Consolidated Account Statements(e-CAS) that investors and traders receive every month. It also offers services for storing insurance claims and the commodities market receipts for commodities trading offered on platforms like Multi Commodity Exchange of India (MCX).

Subsidiaries

In all, the company owns three subsidiaries:

CDSL Ventures Limited (CVL)

CDSL Ventures Limited (CVL) manages the KYC (Know Your Customer) business. The company is also a vendor for GST Suvidha centres. CVL held over 216 investor records, as of March 31, 2021. The company also maintains a claim registry for life insurance companies that offer Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY).

CDSL Insurance Repository Limited (CIRL)

CIRL is regulated by the Insurance Regulatory and Development Authority of India (IRDAI) and is in the business of enabling policyholders to hold life policies, motor policies, health policies, and all other types of general (non-life) policies

CDSL Commodity Repository Limited (CCRL)

Just like share trading involves storing ‘share certificates’ in an electronic form. The commodities markets involve storing electronic warehouse receipts(e-NWR) for goods bought or sold. CCRL is regulated by the Warehousing Development and Regulatory Authority (WDRA) and is in the business of holding and transacting in electronic negotiable warehouse receipts (e-NWR).

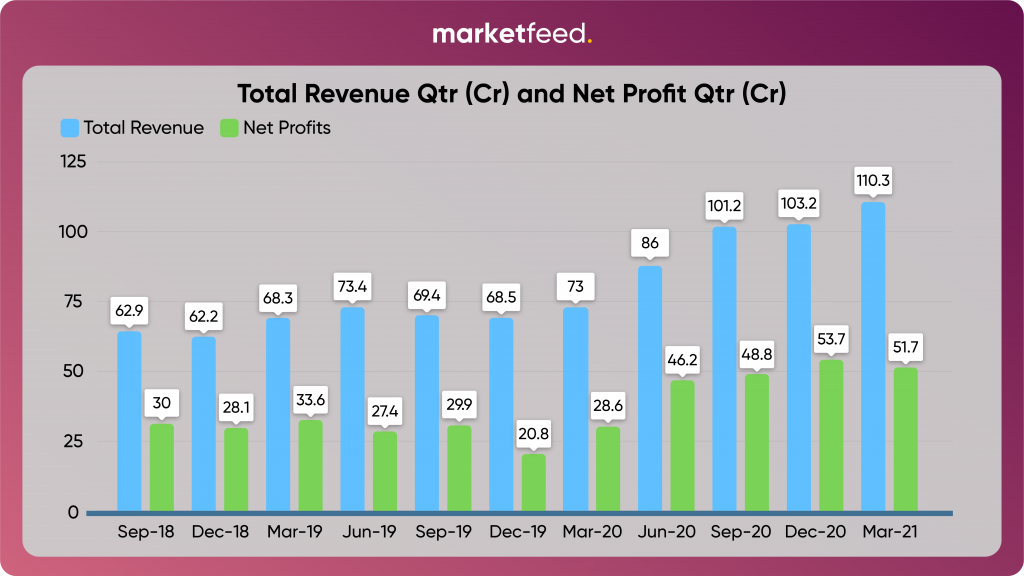

Supportive Financials

- The company’s revenue and net profit have grown consistently since September 2018 as shown in the chart above. The company has grown at a CAGR of close to ~16% over the past 3 years. In the most recent quarterly results for Q4FY21, the company’s revenue grew by ~51% YoY. The Net Profit grew by ~89% YoY.

- CDSL has an Asset-Light Model. The company does not have to invest in heavy machinery, land, or other fixed assets. This meant that the company does not have many fixed costs associated.

- CDSL’s main costs are Employee Wages and Benefits, Computer Technology Related Expenses which are largely fixed in nature. Any increase in revenue will naturally reflect on net profits.

- The company operates on zero debt.

- The share price of the company has increased by ~272% over the past year and ~240% over three years. This could mean your investment in the stock would have multiplied more than 3.5x had you invested in the stock.

- The company’s charts suggest that the stock picked up most of its activity in 2020. Trading volumes were relatively insignificant before that. The stock price is supported by strong volumes. FII or Foreign Institutional Investor’s shareholding in the company has increased by a staggering 7% in FY 2020-21.

Conclusion

Let me tell you about the risks associated with CDSL. CDSL’s profit numbers are cyclical, just like the stock market. The more people invest, the more money it makes. Any reduction in trading or delivery volumes could impact profits. For the long term, the company needs to tackle regulation by SEBI, at the same time improving its technology. The company’s expenditure on employees’ salaries has increased over the years.

The rally that CDSL saw in FY2020-21 filled many pockets. At this point, there are two possibilities, there could be profit booking which could mean that the share prices would eventually fall. The second possibility could be that the stock breaks the glass ceiling and the price would increase further. The only thing that is crystal clear is the monopoly that CDSL has in their domain, and this is likely to push long-term growth.

One can only speculate for the short term. What do you think about the stock? You may let us know in the comments section below!

Post your comment

No comments to display